Background

On 24 September 2020, the Australian Government announced its proposed major reforms to insolvency laws to support small business recovery and to streamline the insolvency process. The reforms are expected to commence on 1 January 2021, subject to the passing of legislation. The reforms will adopt features from Chapter 11 of the United States Bankruptcy Code, being a “debtor in possession” corporate insolvency model.

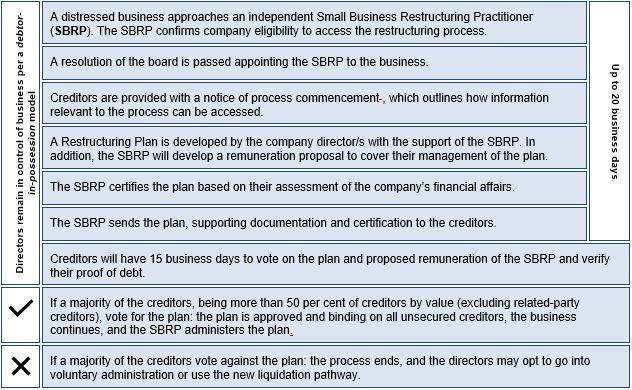

What is the new Restructuring Process?

The proposal offers the following new debt restructuring process for financially distressed yet viable businesses.

During the restructuring process outlined above, unsecured and some secured creditors will be prevented from taking action against the company and enforcing personal guarantees against directors or their relatives. Protection will be afforded against ipso facto clauses triggered by the company entering the restructuring process.

There are safeguards included to prevent the restructuring process from facilitating corporate misconduct. These safeguards include:

- prohibition on related-party creditors voting on the Restructuring Plan;

- a bar on the same company directors using the process more than once (within 7 years); and

- the provision of a power for the SBRP to stop the restructuring process where misconduct is found.

What is the eligibility criteria?

- The processes above will be available to incorporated businesses with liabilities of less than $1 million.

- All employee entitlements that are due and payable are paid before the restructuring plan can be put to creditors.

What are the transitional protections?

It is expected that some eligible companies will be unable to access the new processes immediately on 1 January 2021 as it will take SBRPs some time to register and familiarise themselves with the new regime.

As such, the following process will be available to eligible small businesses to assist with the transition:

- an eligible small business will be able to declare its intention to access the new restructuring process to its creditors including through ASIC’s published notices website until 31 March 2021; and

- following their declaration, the existing temporary insolvency relief (relief from insolvent trading liability and responding to statutory demands from creditors) will apply to the business for a maximum period of 3 months, until they are able to access an SBRP or other insolvency practitioner.

What is the new Liquidation Pathway?

The new simplified liquidation process will retain the general framework of the existing liquidation process, with modifications proposed to reduce time and cost.

Key modifications

The key modifications include:

- reduced circumstances in which a liquidator can seek to clawback unfair preference payments from a creditor unrelated to the company;

- reduced reporting requirements to ASIC on potential misconduct;

- removing requirements to call creditor meetings and the ability to form committees of inspection;

- simplifying dividend and proof of debt process; and

- maximising technology neutrality in voting and other communications.

The rights of secured creditors and the statutory rules as to the payment of priority creditors such as employees will not be modified.

There are safeguards included to prevent the liquidation pathway from facilitating corporate misconduct. These safeguards include:

- allowing creditors to convert the liquidation back to a ‘full’ process;

- a bar on the same company directors using the process more than once (within 7 years); and

- requiring company directors to declare they believe the company is eligible and has not been engaged in illegal phoenixing.

What are the complementary measures?

In addition, the Government proposes to introduce the following measures to respond effectively to increased demand and the needs of small businesses post COVID-19:

- encourage insolvency practitioners to re-enter the market by temporarily waiving fees associated with registration as registered liquidator until 30 June 2022;

- allowing increased participation in the market of insolvency practitioners by removing currently unbeneficial ‘rigid requirements;

- making the key parts of the process set out in the Corporations Act 2001 ‘technology neutral’ so that external administrations can be carried out efficiently, allowing the administrators to focus on the substantive requirements of their role;

- allow eligible companies that have announced their intention to access the new restructuring process, to benefit from the existing temporary insolvency relief for up to 3 months whilst they wait to access the new process; and

- establish a new classification of insolvency practitioner whose practice will be limited to the new restructuring process.

The Government also announced that it will commence a consultation on the appropriateness of permanently raising the minimum threshold at which creditors can issue a statutory demand on a company. This will be a significant development affecting debtors, creditors and insolvency practitioners.

Road ahead

The draft legislation is yet to be released. Until the legislation is released, there will continue to be uncertainties. It is hoped the legislation will assist to clarify issues relating to:

- the criteria of an acceptable Restructuring Plan;

- qualifications required to assume the role of SBRP;

- the relevant time periods and qualifications for any voidable transactions;

- whether there might be Court intervention; and

- what the corporate misconduct safeguards for the new processes will look like, how they will apply and the duties they may impose on the SBRP (e.g. how the SBRP might be expected to action findings of corporate misconduct).

In these unprecedented times and with the continuing impact of COVID-19, the timeliness of the proposed reforms may provide the flexibility and opportunity needed by small businesses to recover while balancing the interests of creditors.

The team at Hicksons is able to provide expert support on these issues.

Post by Hicksons Partner, Marc Rossi, Associate, Roxanna Lam, and Solicitor, Gumneet Mangat.